Contents

Quantopian vs QuantConnect Review

Back-testing Platforms Coming of Age

Many years ago, one needs to build their own back-testing frameworks from scratch using languages like Matlab, R, .NET, Java etc. Then came a few open sourced community provided platforms that saved us some work. And now there are numerous platforms that are beginning to democratize quant strategy research and make it easily accessible to everyone who is interested to participate.

You can see a whole lot of them mentioned in following links:

http://www.quantstart.com/articles/Choosing-a-Platform-for-Backtesting-and-Automated-Execution

Prominent Platforms

Amongst the many available, it seems to me the most prominent 2 lately seems to be Quantopian and QuantConnect.

http://www.quora.com/Algorithmic-Trading/What-do-professional-traders-think-about-Quantopian

http://www.quora.com/Algorithmic-Trading/What-are-competitors-to-Quantopian

Why This Article?

This article was inspired by the discussions at the following post.

We decided to test drive Quantopian and QuantConnect as objectively as possible and see which one we liked more. We are not affiliated to either of them.

Overall, we are Impressed

First of all, we must say we are very impressed by:

- The in-browser IDE provided by both Quantopian and QuantConnect. For someone with some development experience, the IDEs were very easy to pick up and understand. We are old school and nostalgic – Quantopian’s reminded us of our old emacs editor while QuantConnect’s reminds us of our Visual Studio days.

- The very very nice ability to share strategies and clone existing strategies written and discussed in the community forums into our workspace for us to work off. These definitely helped ease the learning curve.

- Both have engines that they open sourced (ZipLine and Lean Engine). Wow!

Here’s The Test Drive

For our test-drive, we decided to implement a toy and naïve intraday momentum strategy over 5 randomly selected US stocks at 1 minute frequency over 10 years back-test period.

- Go long small amount of the stock if its price now is higher than 15 minutes ago.

- No position otherwise

This means the strategy never goes short any stocks and just trades in and out of its positions and toggles quickly between being long and being flat. Not going to make us much money but simple enough to code up and generates a fair bit of trading activity to stress test the back-testing platform at the 1 minute frequency.

Time Taken To Build Simple Momentum Strategy

Quantopian’s users have to write their code in Python (based on Zipline.IO library) while QuantConnect’s users have to write their code in C#. We have comparable experience in both languages.

We spend roughly 4 hours on each platform to figure out how to build and debug our momentum strategy which came to somewhere between 50-100 lines of code. So in terms of learning curve and productivity, honestly, we thought it was really quite comparable.

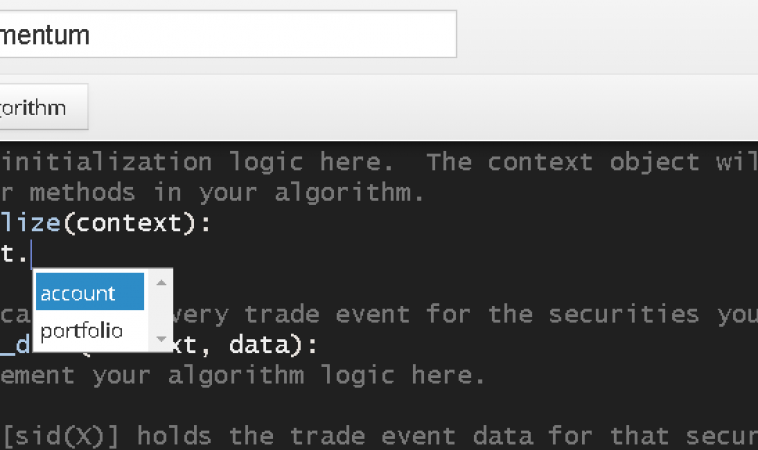

Both Quantopian and QuantConnect had wonderful in browser IDE and help like intellisense.

Halfway coding up strategy on Quantopian

Halfway through coding up strategy on QuantConnect

Simulation Running!

Here are some differences based on my experience:

| Quantopian | QuantConnect | Winner | |

| Instrument Support | Equities: US Only since 2002 | Equities: US Only since 1998. FX Majors: since 2007 | QuantConnect |

| Equity Fundamental Data | Available from Morning Star | Not available yet but I believe should be soon | Quantopian |

| Speed of back-test (10 years intraday momentum) | Tried twice and both took 16 minutes to complete. | This was weird. Tried the simulation twice and in both cases at the 20 minutes mark, the simulation was only half done (completed 5 years so far).I was under the impression QuantConnect’s C# based platform should be faster than Quantopian’s Python based platform. Maybe my strategy implementation was very inefficient or leaked memory somehow? | Thought should be QuantConnect but Quantopian was faster?Someone else can benchmark for me and let me know what you find |

| Real money trading support | Yes through Interactive Brokers | Yes through Tradier, Interactive and others | Tie |

| IDE intuitiveness learning curve, documentations | Love it! | Love it! | Tie |

Overall

Both platforms are amazing. we wish we had both Quantopian and QuantConnect to choose from years ago.

If we were to choose one right now, we would have slight preference for Quantopian because:

- If we want to use a bit of machine learning, we would use convenient Python quant trading libraries like SKlearn

- We liked the strategies discussed by the Quantopian a bit better. Eg we found these interesting:

- https://www.quantopian.com/posts/system-based-on-easy-volatility-investing-by-tony-cooper-at-double-digit-numerics

- https://www.quantopian.com/posts/etf-market-rotation-strategy

- https://www.quantopian.com/posts/olmar-3-dot-0-using-new-order-and-history-features

- https://www.quantopian.com/posts/olmar-implementation-fixed-bug

- https://www.quantopian.com/posts/spy-and-sh-minute-data

- Quantconnect is a worthy Quantopian competitor

Suggestions for both platforms

Both teams have done amazing jobs. Here are some suggestions for both:

- Would be nice if they support version control of strategies so we can easily compare current version of the strategy implementation with the previous one, in terms of both code differences and key profitability metrics.

- Really look forward to longer histories and more asset classes like Futures, FX and options etc

Hope you enjoyed our Quantconnect vs Quantopian review !

Brought to you by RobustTechHouse. We provide Fintech Development services.

Thanks for the great write up Robust Tech House! Just some fact corrections for the article:

– QuantConnect supports FX already and can support many asset classes including futures. The open source community is already exploring these and building them privately 🙂

– QuantConnect has version control tagged to each backtest, so you can clone an algorithm from a specific backtest.

– QuantConnect also has all the community posts and blog articles you mentioned above and more! I’d recommend checking out the forums.

– Our basic template benchmarks are 15x faster than Quantopian; that is the best point of comparison and is independent of any user algorithm implementation. It looks like your algorithm actually has a run-time error (red triangle). If you want help we can review your implementation.

– We have open-source math libraries (http://www.mathdotnet.com/) like MathNet.Numerics, MathNet.Filtering and AForge. They are very deep and stable. I’d highly recommend checking them out as math libraries really aren’t a factor here IMHO.

Hey Jared,

Thanks v much. Very fair points. We will check out all these info you mentioned.

First of all, thank you for your post. majorsite Your posts are neatly organized with the information I want, so there are plenty of resources to reference. I bookmark this site and will find your posts frequently in the future. Thanks again ^^

I’ve been searching for hours on this topic and finally found your post. baccarat online, I have read your post and I am very impressed. We prefer your opinion and will visit this site frequently to refer to your opinion. When would you like to visit my site?

I work as a software tester. And I can work from anywhere in the world, the main thing is that there is an Internet connection. That’s why I decided to go to Alicante for the winter months. Immediately at the airport, I hired a car so that it would be convenient for me to move around the city.

I appreciate you sharing this. The pioneers of the cutting-edge continually amaze and motivate me. What a joy it is to witness something brand new taking form! tanuki sunset

i am seeing new dress for girls

Step up your fashion game with Walkeaze latest collection of High Heels shoes for women. With a wide range of shoes, including high heels and wedge heels, we have something for women. So, get your favorite heels today.

Find a superior selection of baby products. Our collection has everything you need to make sure your baby is comfortable and happy, from adorable clothing and goods to safe and recyclable toys. Buy the best products that you and your baby will love!